SUITE LEGAL SERVICES

The "Suite Legal Service" is the suite which consists of 8 products each one is specific to your topic of interest.

The streights of the Suite is the interconnection between all the products, which allow a unitary and complete vision of the subject / customer that is the protagonist.

The Suite is the result of years of study, experience and careful market analysis.

• GFUG - Single Justice Fund

GFUG, The specific solution for managing the Single Justice Fund

Read More >

• GFUG - Single Justice Fund

GFUG, The specific solution for managing the Single Justice Fund

Read More >

In line with the objective of rationalizing the management of sums administered by the justice system, the Legislator with the D.L. 143/2008, converted into law 181/2008, containing "Urgent Interventions on the Functionality of the Judiciary System, established the Single Justice Fund.

Following the important and innovative intervention of the Legislator, the GFUG Single Justice Fund was born - a dedicated engine for the management of seized or unquestioned relations to be held by the Single Justice Fund.

The peculiarities of GFUG are:

- The management and control of the process of acquiring and sending the outbound flow to Equitalia;

- The engagement of the owners and all the subjects connected to it;

- The transfer and the mirror accounts (complete with interest calculation);

- Communications to Equitalia;

- Return flow management;

- The communication of the result of the transmission through the application

The GFUG application is proposed as a new solution for the entire management of operations, deadlines and all communication to and from Equitalia, with practical Workflow and automatic data management in order to reduce errors in manual operation.

Recipients

- Administrative management

- Business management

• ImpRev - Irevocable amount

Imprev is the solution of Micra for the management of the calculation of the revocable amount, against a bankruptcy re-vocation.

Read More >

• ImpRev - Irevocable amount

Imprev is the solution of Micra for the management of the calculation of the revocable amount, against a bankruptcy re-vocation.

Read More >

The product allows the calculation, both in advance and in the insolvency phase, of the revocable amount through the following functions:

- The insertion of movements and exposures (from central system, from excel list, and / or through manual insertions);

- Choice of data ordering and observation period;

- The exclusion from the calculation of the movements indicated as "ignore";

- The choice and the variation of the ordering criterion of the movements in the single day and / or the exclusion of one or more movements and the exclusion of loan variations.

For each practice of Bankruptcy Revocatory inserted, Imprev, takes care of calculating and printing the list of daily movements that can be customized by type. IMPREV It is aimed at bankruptcy banks and trustees.

Recipients

- Ordinary Credit Department

- Anomalous Credit Department

- Litigation Department

• ApSuc - Successions

Intended for both the Head Office and branches, this product allows you to follow and speed up the delicate phase of succession mortis causa.

Read More >

• ApSuc - Successions

Intended for both the Head Office and branches, this product allows you to follow and speed up the delicate phase of succession mortis causa.

Read More >

Structured in paperless optics, attention that distinguishes all the products of the Suite of Micra, Apsuc allows you to find all the reports related to the de cuius taking advantage of the direct connection with the general registry of the Bank, without the need to exit the application, thus allowing the office to draw up and send all the documentation of the Bank with extreme ease.

Particular importance in this context is the messaging - placed on the front page, through which the branch is put in contact with the head office in order to find all the necessary information, in a short and concise time.

Great use and note of merit is attributed to the massive reports that allow the operator to enter data and save them via PDF or Excel, so as to allow maximum clarity and complete in-depth view of the subject in question.

Recipients

- Headquarter

- Branch

• APIG3 - Foreclosure of the third party

The exponential increase of the executive procedures with third parties, make this product the fundamental tool for their correct management.

Read More >

• APIG3 - Foreclosure of the third party

The exponential increase of the executive procedures with third parties, make this product the fundamental tool for their correct management.

Read More >

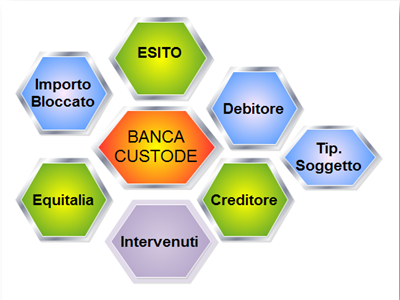

Peculiarity of the product is the automated management of the whole process-execution phase, allowing a clear reduction of the processing time of the practice.

APIG3's characteristic is to draw up the declaration to be forwarded to the creditor by filling out a wordembedded model - agreed with the client - simultaneously with the use of the application, without the burden of having to close and open two work windows, with the consequent loss of time that this entails.

In a single click, APIG3, identifies the subject subjected, shows if the same is customer of the Bank (through links with the registry office of the Bank), identifies all the accounts linked to it, provides, in the case, to block them and, finally, send the declaration of the third through PEC, all in a paperless optics.

The product also allows the Bank to adapt to the timing of the executive procedure with the double benefit of speeding up the times, enjoying maximum precision, thus correctly fulfilling the obligation imposed by law.

Recipients

- Branch

- Profiles also for Treasury / Human Resources